maricopa county tax liens for sale

No Pressure Simply World Class Service and Help. There are currently 11375 tax lien-related investment opportunities in Maricopa County AZ including tax lien foreclosure properties that are either available for sale or worth pursuing.

Maricopa County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

Interested in a tax lien in Maricopa County AZ.

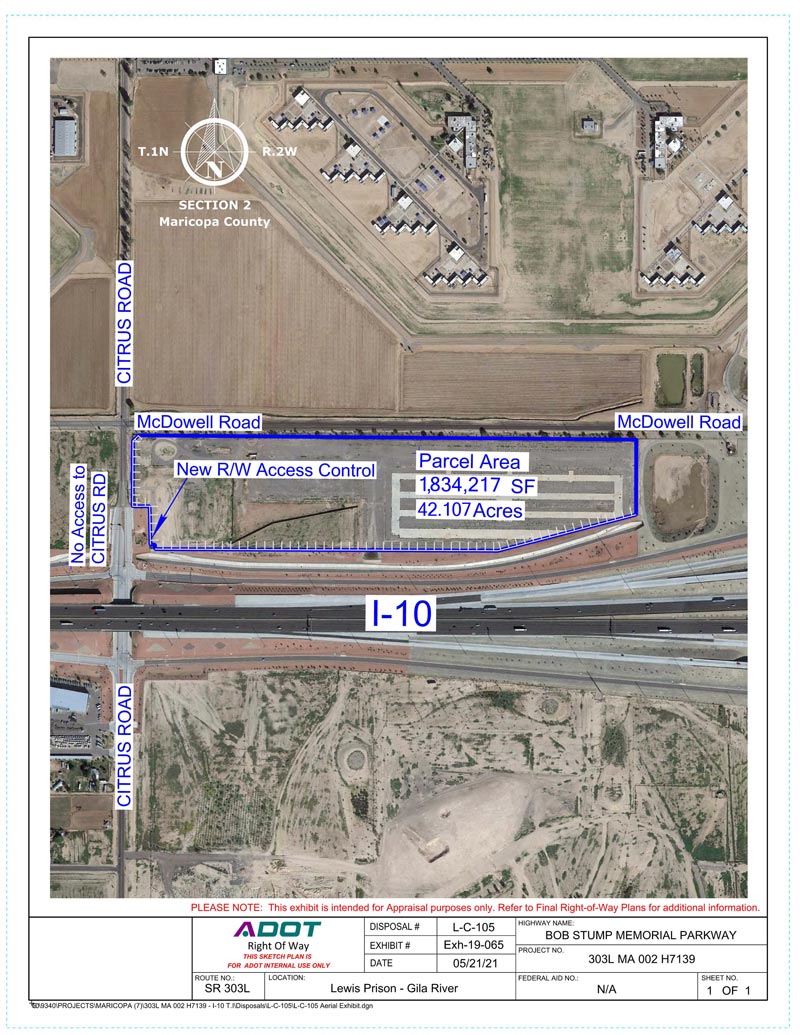

. General Deed to MARICOPA COUNTY MUNICIPAL WATER CONSERVATION DISTRICT NUMBER ONE a political. Maricopa County AZ currently has 14 tax liens available as of June 15. Maricopa County AZ currently has 2496 tax liens available as of December 25.

Number previous owner property description base tax interestfees total tax due at conveyance to state total cost to foreclose total due at conveyance to state 1. Shop around and act fast. Pursuant to ARS 42-18106 a listing of each parcel showing the parcel number delinquent tax amount.

Tax liens offer many opportunities for you to earn above average returns on your investment dollars. List of parcels currently held. For additional information on Tax Deeded Land Sales you may contact the Treasurers Office at.

Ad Find Tax Lien Property Under Market Value in Maricopa. You can now map search browse tax liens in the Apache Coconino Maricopa Pinal and Yavapai 2022 tax auctions. The sale takes place in February.

The Maricopa County Treasurers Tax Lien Web application allows you to monitor your CP Buyer account with Maricopa County. Register for 1 to See All Listsings Online. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in.

The Treasurers tax lien auction web site will be available. The sale of Maricopa County tax lien certificates at the Maricopa County tax sale auction generates the revenue Maricopa County Arizona needs to continue to fund essential. Ad With a Low Inventory Market Strategy is a Crucial Step in Planning a Move.

Ad Buy HUD Homes and Save Up to 50. Just remember each state has its own bidding process. Acquire Valuable Properties Or Get 18-36 Interest.

Put My Expertise to Work for You. 602-506-8511 or the Clerk of the Boards Office at. The place date and time of the tax lien sale.

Maricopa County Treasurers Home Page. Detailed listings of foreclosures short sales auction homes land bank properties. As of October 2 Maricopa County AZ shows 1469 tax liens.

The Maricopa County Treasurers Office MCTO makes every reasonable effort to maintain accurate data for the map as a service to the community. Ad Tax Lien Certificates Yield Great Returns Possible Home Ownership. Maricopa County AZ currently has 18020 tax liens available as of July 1.

Maricopa County CA tax liens available in CA. The Tax Lien Sale of unpaid 2018 real property taxes will be held on and. 2022 Tax Sale Details.

The tax on the property is auctioned in open competitive bidding based on the least percent of interest. Property taxes that are delinquent at the end of December are added to any previously uncollected taxes on a parcel for the Tax Lien Sale. Delinquent and Unsold Parcels.

Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax. Please mail completed forms to Maricopa County Treasurer 301 W Jefferson St 140 Phoenix AZ 85003 or fax to 602 506-1102. HUD Homes USA Is the Fastest Growing Most Secure Provider of Foreclosure Listings.

The Tax Lien Sale provides for the payment of delinquent property taxes by an investor. How does a tax lien sale work. What is the tax.

Ad Compare foreclosed homes for sale near you by neighborhood price size schools more. Check back for regular updates to the county tax sales as. The Tax Lien Sale will be held on February 9.

Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in. To be eligible to bid you must complete the following steps on the auction web site. A number will be assigned to each bidder for use when.

When a Maricopa County AZ tax lien is issued for. To appeal the 2012 assessment go to maricopagov assessor or. The sale of Maricopa County tax lien certificates at the Maricopa County tax sale auction generates the revenue Maricopa County Arizona needs to continue to fund essential services.

These listings may be used as a general starting point for your. Search Bank Foreclosures Auctions Short Sales REOs Pre-Foreclosures and Tax Sales. Find the best deals on the market in Maricopa County CA and buy a property up to 50 percent below market value.

Check your Arizona tax liens. The Tax Lien Sale of unpaid 2020 real property taxes will be held on and closed on Tuesday February 8 2022. The Maricopa County Recorders Office presents the information on this web site as a service to the public.

August 2017 TAX LIEN SALES Below is a partial listing of materials available on this topic in the Superior Court Law Library.

Delinquent Property Tax Lien Sale Overview Arizona School Of Real Estate And Business

The Essential List Of Tax Lien Certificate States

Is Arizona A Tax Lien Or Tax Deed State The Answer May Surprise You

Property Taxes Maricopa 2022 The Benefits

Faq On Real Property Tax Lien Foreclosures Hymson Goldstein Pantiliat Lohr Pllc

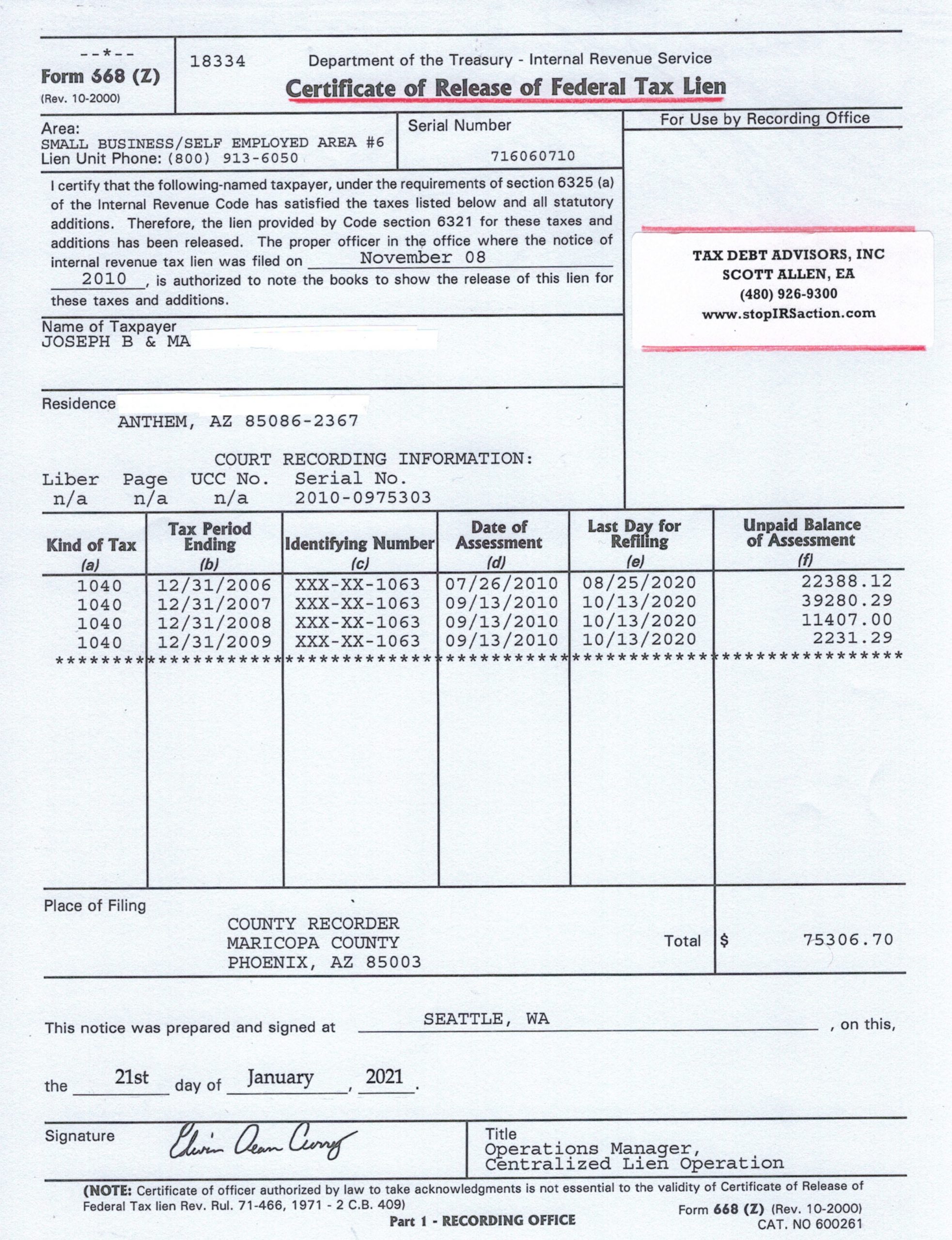

Irs Tax Lien In Arizona Irs Help From Tax Debt Advisors Inc Tax Debt Advisors

Property Taxes Maricopa 2022 The Benefits

Maricopa County Treasurer S Office John M Allen Treasurer

Maricopa County Treasurer S Office John M Allen Treasurer

Tax Liens Tax Lien Foreclosures Arizona School Of Real Estate And Business

Residential Rentals In Maricopa County Must Be Registered The Arizona Report

Tax Liens Winner For County Not Investors Law Office Of D L Drain P A Arizona Bankruptcy Lawyer